What is a Resort and Local Option Tax?

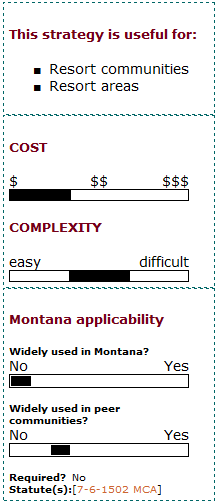

Resort and local option taxes serve the function of creating a funding source for local transportation to finance a variety of transportation system improvements. They are collected in certain Montana communities with populations under 5,500 who meet specific resort qualifications. The fundamental idea behind resort taxes is to allow places with high numbers of visitors but relatively few residents to manage the wear-and tear on local infrastructure without overburdening local citizens.

The resort tax is a local option sales tax on the retail value of goods and services sold by lodging and camping facilities, restaurants and other food service establishments, public establishments that serve alcoholic beverages by the drink, destination recreational facilities, and establishments that sell luxuries. The rate is set locally and cannot exceed three percent. A local government agency administers the tax.

Montana's legislation approving a resort tax has been very successful in raising revenues for tourist areas. Resort taxes can be levied in rural, urban, and rapidly growing contexts, depending on the area being served. Often, the resort tax is beneficial in preventing rapidly growing tourist areas from encroaching on national park land or preserved rural areas around the tourist site.

Who can implement it?

Resort and local option sales taxes are special-purpose taxes implemented and levied at the city or county level. The tax is appended onto the state's base sales tax rate but applied only within the cities or counties in which it is implemented. Resort taxes can span a more regional context, often covering multiple municipalities encompassed by a national park or resort site, although only cities with population under 5,500 can qualify for the tax.

Resort and local option taxes are signed into law in Montana at the state level. Under state law, districts with resort taxes are divided into two categories: communities and areas. Resort communities are incorporated towns with populations less than 5,500 and resort areas are unincorporated entities with fewer than 2,500 people. Places that exceed those population limits are not allowed to put resort tax proposals on any ballots. Currently, Montana's resort tax communities are Whitefish, Red Lodge, Virginia City, and West Yellowstone. The resort areas are St. Regis, Big Sky, and Seeley Lake.

The 2009 Legislature considered a bill to adjust the upper threshold population level requirement for resort communities. The Legislature did not change the upper population limit but revised the law to consider the population at the time of the most recent federal census instead of the federal population estimates produced annually.

NOTE: Montana also has a "bed tax" of 4% on overnight lodging that supports the state's tourism promotion efforts and also contributes funds to state parks, historic sites, and other important programs. Lodging facilities (such as hotels, motels, bed & breakfast inns, guest ranches, resorts and campgrounds) collect this tax from guests. In turn, these funds are directed to the Montana Historical Society, the University System, the Department of Fish, Wildlife & Parks, Montana's tourism regions and visitor bureaus, and the Department of Commerce for travel and film location promotion. A portion of the bed tax currently supports tourism-related infrastructure around the state.

What are the keys to success and potential pitfalls?

Expenditure Plan: With respect to consideration of resort taxes, a large hurdle to overcome is gaining voters' approval. An expenditure plan that specifies projects and/or programs to be funded with the new local option tax levies is not always required. However, local option taxes have a better chance of success at the ballot box (and for implementation in general) where expenditures and uses are clearly defined. Implementation plans that are well designed have resulted in very high success rates for ballot measures to enhance transportation revenues.

Where has this strategy been applied?

Examples in Montana

- City of Whitefish Resort Tax: The City of Whitefish has been designated as a "resort community" by the state, and has implemented a resort tax that devotes a portion of the revenue to making street improvements and implementing trails projects. The City of Whitefish earmarks 65 percent of annual resort tax revenue for street improvement projects. Another 25 percent goes to tax relief and the remaining 10 percent is divided between contributing businesses and local parks. The community has been very successful at getting transportation system improvements built since it adopted the tax.

- Big Sky Resort Tax: This three-percent sales tax was passed in 1992 to improve the community of Big Sky, Montana. Since its inception, the money raised from the tax has played a significant role in the funding of services and programs that provide for the public health, safety, and welfare within the Big Sky Resort Area District. Funds have been used for tourism development, infrastructure facilities, post office services, ambulance and emergency services, public transportation systems, parks and trails, the community library, and other services.

- West Yellowstone Resort Tax: The first town to adopt a resort tax, West Yellowstone has funded much of its infrastructure improvements and maintenance through resort taxes for two decades. For example, resort tax funds have been used to make significant upgrades to water and wastewater systems and to pave all the streets within the town.

Examples outside of Montana

States that allow for local option sales taxes include:

- Iowa

- Tennessee

- Nebraska

- Vermont

- Minnesota

- California

- Nevada

Several western states including Utah, Wyoming, and Idaho have adopted legislation that allows for resort communities to levy special sales taxes for sales in tourism-related businesses.

How can I get started?

Legislation to allow broader use of local option sales taxes in the state has been introduced in past legislative sessions, most recently during 2009 (Senate Bill 506); however, these taxation measures have not been approved to date.

Since Montana statutes only allow for the use of specific type of local option sales tax (resort tax), this potential funding mechanism is not available to all communities in the state. Such taxes may be implemented only in areas meeting the criteria for resort areas or resort communities as established in Montana code. A key consideration is that the resort area or community must first be designated as such by the Montana Department of Commerce.

Qualified resort communities and resort areas can begin by researching the experiences of Montana communities that have already implemented the tax. In particular, they should look at the strategies used to gain voter approval of the tax, and the level of staff resources needed to develop and maintain the expenditure plan. Areas not currently designated as resort areas or communities can begin by discussing the process of qualification with the State Department of Revenue.

Where can I get more information?

- Montana Department of Revenue

- Local Option Transportation Taxes in the United States (Part One: "Issues and Trends"), March 2001 Todd Goldman, Sam Corbett and Martin Wachs

- Local Option Transportation Taxes in the United States (Part Two:"State-by-State Findings")